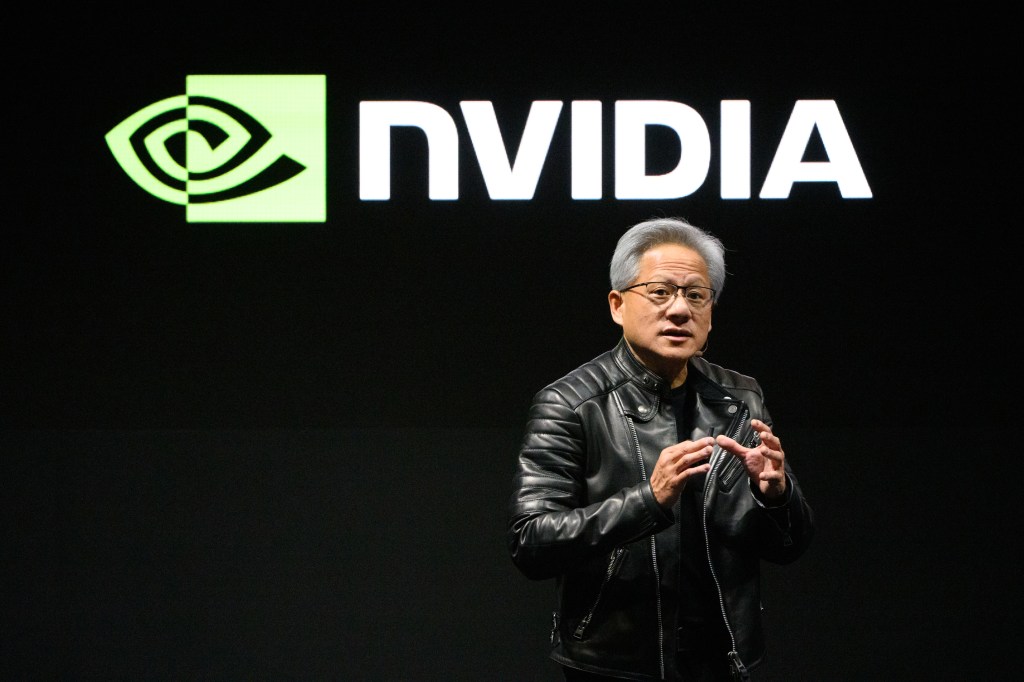

Nvidia’s journey in harnessing the potential of AI has seen a remarkable rise. The ChatGPT introduction two years ago sent its revenues, profitability, and cash reserves on an impressive upward trajectory. This unprecedented growth enabled Nvidia to grow its investments, chiefly focusing on AI startups.

Intensifying investment activity in 2024, Nvidia participated in 49 rounds of financing for AI companies, a stiff climb from 34 in 2023. These figures reflect an unprecedented investment growth when compared to the prior four years, which saw Nvidia fund only 38 AI ventures.

Nvidia’s investments, distinct from its VC fund NVentures’ investments which also surged lately, target startups identified as potential game changers and market disruptors in the AI ecosystem.

In the past two years, Nvidia edged out other tech behemoths with 83 deals, surpassing Alphabet’s 73 and Microsoft’s 40.

Ventures with Over $1B Funding

The standout billion-dollar round investments include those in OpenAI, xAI, Inflection, Wayve, Safe Superintelligence, and Scale AI.

Ventures with multi-hundred-million-dollar funding

This bracket includes upcoming startups Crusoe, Figure AI, Mistral AI, Cohere, Perplexity, Poolside, CoreWeave, Sakana AI, Imbue, and Waabi.

Ventures with over $100M Funding

Nvidia also marked its presence in the $100M+ funding league, investing in promising startups Ayar Labs, Kore.ai, Weka, Runway, Bright Machines, Vast Data, and Enfabrica.

Thus, Nvidia’s venture capital activities reach across the AI landscape, backing startups and encouraging their innovative endeavours in AI.

Original source: Read the full article on TechCrunch