Amazon has confirmed its purchase of Indian BNPL (Buy Now, Pay Later) startup Axio, enriching its financial services portfolio in one of the company’s high-growth markets. The retail juggernaut, an investor in Axio for six years, formalised the acquisition in December, said the Indian firm.

While the financial specifics have not been revealed, sources told TechCrunch the acquisition sum exceeds $150 million. Approval from India’s central bank is still pending for this deal.

The BNPL specialist, Axio, also known as Capital Float, raised approximately $135 million in funding from investors such as Peak XV Partners, Ribbit Capital, and Elevation Capital.

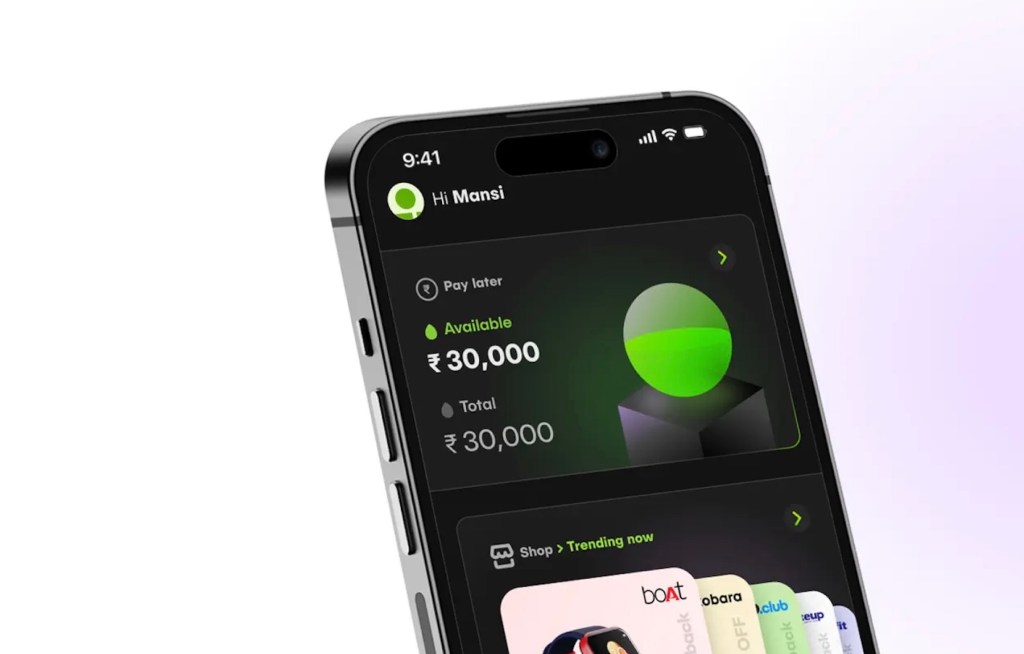

Providing credit facilities to self-employed individuals and domestic households on significant e-commerce platforms like Amazon and MakeMyTrip is Axios’s speciality. With over 10M clients, its loan portfolio is estimated to be worth over $260M.

Axio is addressing the gap related to traditional credit accessibility in India, where small-ticket loans are not deemed profitable by conventional banks. Their regulated lending platform is designed for quick customer credit-worthiness assessments, enabling credit decisions within a few seconds and clicks.

Though Axio has faced growth sustainability struggles like other startups in this sector, including the Goldman Sachs-backed ZestMoney, which was later acquired by DMI Group.

The startup’s acquisition comes as the second Amazon purchase in India in the past year, following on-demand video streaming service MX Player last June. So far, the tech behemoth has dedicated over $10 billion to India for its operations.

Original source: Read the full article on TechCrunch